The post Solana (SOL) Set For Bull Run, Insights From On-Chain Data appeared first on Coinpedia Fintech News

Solana (SOL), the world’s fourth-largest cryptocurrency by market capitalization, is poised to continue its upward momentum as on-chain metrics shift in favor of whales. After a sharp price decline, SOL found support at $205.5 and resumed its upward trajectory. It is poised to continue its upward momentum in the coming days.

Solana (SOL) Bullish On-chain Metrics

The on-chain metrics, trading volumes, and traders’ rising interest in the altcoin indicate that SOL is poised for short-term upside momentum.

According to the on-chain analytics firm DefiLlama, traders’ interest and liquidity in the SOL chain appear to be rising. Data shows that SOL’s daily trading volume has skyrocketed from $2.91 billion on December 7, 2024, to $6 billion on December 11, 2024, reaching its highest level since November 2024.

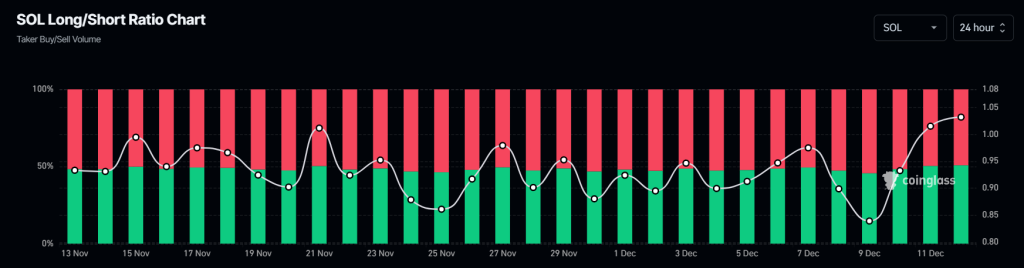

Additionally, Coinglass’s SOL Long/Short ratio has reached its highest level since the beginning of November 2024. Although it currently stands at 1.05, this notable rise in the long/short ratio indicates strong bullish sentiment among traders.

When combining these on-chain metrics, it appears that bulls are back and continue to dominate the asset, supporting the upcoming rally.

SOL Technical Analysis and Upcoming Level

According to the expert technical analysis, SOL appears bullish as it has successfully retested the crucial support level of $205.

Based on recent price action and historical momentum, the SOL rally could continue if it breaks through the resistance level at $240. If SOL breaks through this level and closes a daily candle above $241, there is a strong possibility it could soar by 10% to reach $269 in the coming days.

At press time, SOL is trading near $227 and has registered a price surge of over 7% in the past 24 hours. During the same period, its trading volume dropped by 34% indicating lower participation from traders and investors compared to the previous days.