The post MakerDAO to Invest $1 Billion in Tokenized U.S. Treasuries appeared first on Coinpedia Fintech News

MakerDao made a big announcement during ETHCC. MakerDAO is the protocol behind this $5 billion stablecoin DAI, which has announced a major shift in its reserve strategy. The platform plans to invest $1 billion of its reserves in tokenized US Treasury products. This move aims to take advantage of the US Treasuries stability and combine it with DeFi.

Interest from Top Players in the market

There are so many big players in this place but the list includes BlackRock’s BUIDL, Superstate, and Ondo Finance, who are eager to participate in MakerDAO’s investment program. Carlos Domingo- CEO of Securitize and BlackRock’s issuance partner has expressed excitement about this initiative by saying “We think this is a very good move from MakerDAO and we are excited to participate with Blackrock’s BUIDL,”

A very known name is Robert Leshner, the founder of Superstate have also praised the initiative.Robert mentioned that USTB of Superstate is the perfect partner for MakerDAO. Another one is Ondo Finance’s founder, Nathan Allman, who shared similar sentiments and highlighted the alignment with their mission of bringing institutional grade financial products for everyone.

MakerDAO’s Strategic Shift

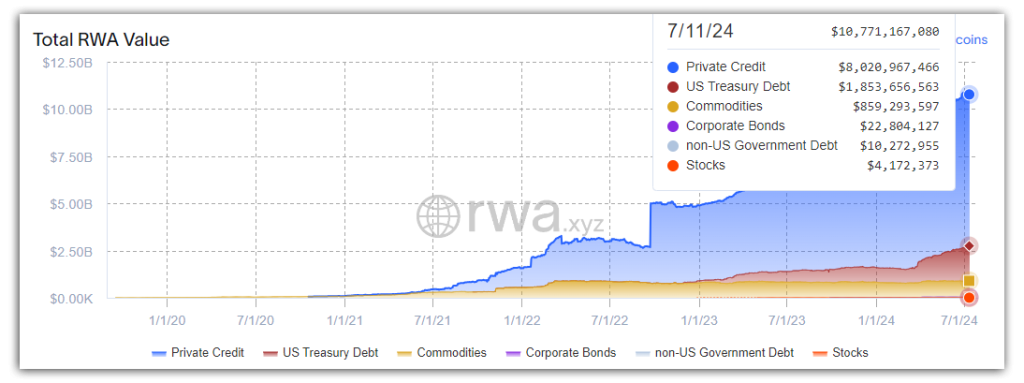

The team identified the main issue in the crypto world: introducing the RWA model sufficiently for sustainability. This investment represents a major restructuring under founder Rune Christensen’s Endgame Plan. The goal is to strengthen MakerDAO’s position in the DeFi sector. MakerDAO leads the trend of real-world asset (RWA) integration in crypto by supporting its decentralized stablecoin with US government bonds and bills held off-chain.

Impact on the Market

U.S. Treasuries have become attractive for protocol treasuries as they offer a low-risk instrument to earn a stable yield. The market for tokenized treasuries has tripled in a year which has reached the $1.85 billion mark. MakerDAO’s $1 billion allocation could lead to another 55% growth in this sector.

Since this news is out the price of MKR has taken a 5.47% rise.

Positive Sentiment for Crypto

This move aligns with the broader trend of cryptocurrencies gaining recognition from major financial institutions. BlackRock, a trillion-dollar giant, sees this space as “new finance” and hopes to participate in MakerDAO’s initiative. The program was announced at ETHCC in Brussels, with applications opening on August 12.

The recent regulatory victories, such as the SEC dropping investigations into Hiro Systems and Paxos, have also boosted confidence in the crypto community. This is a great win for crypto as this is the second investigation the SEC has dropped in two consecutive days.