Ether (ETH) spiked 18% over 24 hours amid new speculation that spot Ether exchange-traded funds could be approved this week — despite months of pessimism.

According to Bloomberg ETF analysts Eric Balchunas and James Seyffart, there has been “chatter” that the United States securities regulator is asking applicants to accelerate their 19b-4 filings.

This has prompted the pair to raise their approval odds from 25% to 75%.

On Polymarket, a decentralized betting platform, odds for an approved spot Ether ETF similarly increased from 11% to 54%.

Ether is now priced at $3,625 and is up 16.1% since the news broke a little over three hours ago and is up 18% over 24 hours, according to CoinGecko.

The news comes days before the U.S. Securities and Exchange Commission must make a final decision on VanEck’s spot Ether ETF application, on May 23.

However, Seyffart made it clear that approved 19b-4s must be accompanied with signed off S-1 registration statements in order for the spot Ether ETFs to launch.

He said it could be weeks or even months for S-1s to be signed off, even if 19b-4s are approved this week.

“That said, if we’re correct and we see these theoretical approvals later this week. It *should* mean that S-1 approvals are a matter of ‘When’ not ‘If’…”

The idea that the SEC could approve the 19b-4 and S-1 filings in a two-part process was first noted by Nate Geraci, president of The ETF Store on May 19.

Related: Spot Ether ETFs will come down to a 5-person vote — Gensler the decider?

Other cryptocurrencies rose over the last 24 hours, including Bitcoin (BTC), Solana (SOL) and Dogecoin (DOGE) at 5.1%, 8.9% and 9.2%, respectively, according to CoinGecko.

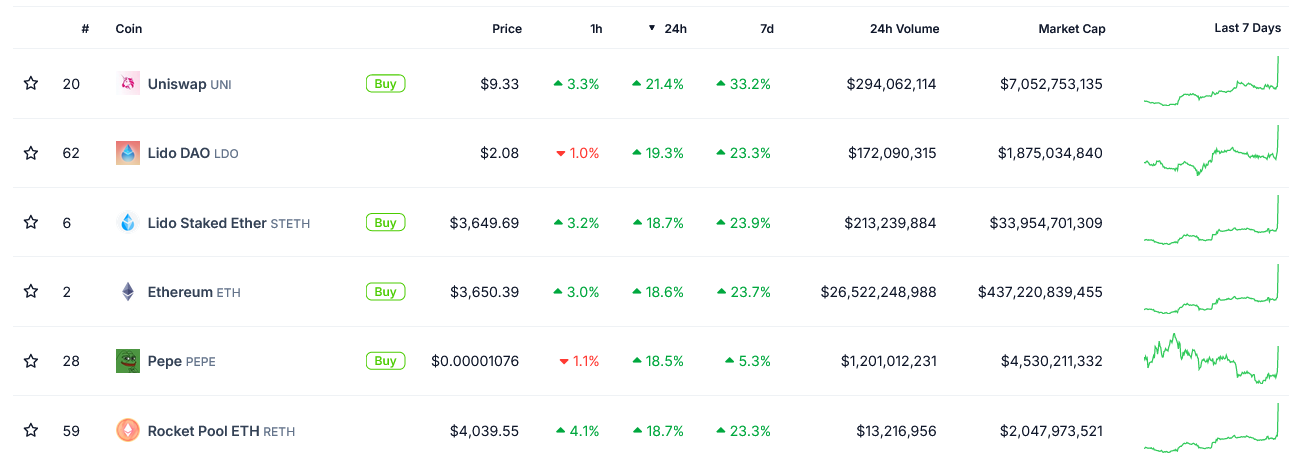

Ethereum-linked Uniswap (UNI), Lido DAO (LDO) and Lido Staked Ether (STETH) are the only top 100 coins by market cap that have outperformed Ether in the last 24 hours, according to CoinGecko.

The broader cryptocurrency market is up 7.8% over the last 24 hours, surpassing a $2.7 trillion market cap for the first time since April 11.

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?