In the rapidly evolving world of trading platforms, DTX Exchange has garnered significant attention with its recent presale success, raising $530K. Unlike its struggling counterparts AR and IMX, DTX Exchange is capturing interest with its innovative approach and promising features.

Introduction to DTX Exchange

DTX Exchange is a multi-faceted trading platform allowing users to trade cryptocurrencies, forex, equities, and contract-for-differences (CFDs). Its innovative infrastructure and unique features distinguish it from traditional and contemporary trading platforms.

Key Features of DTX Exchange

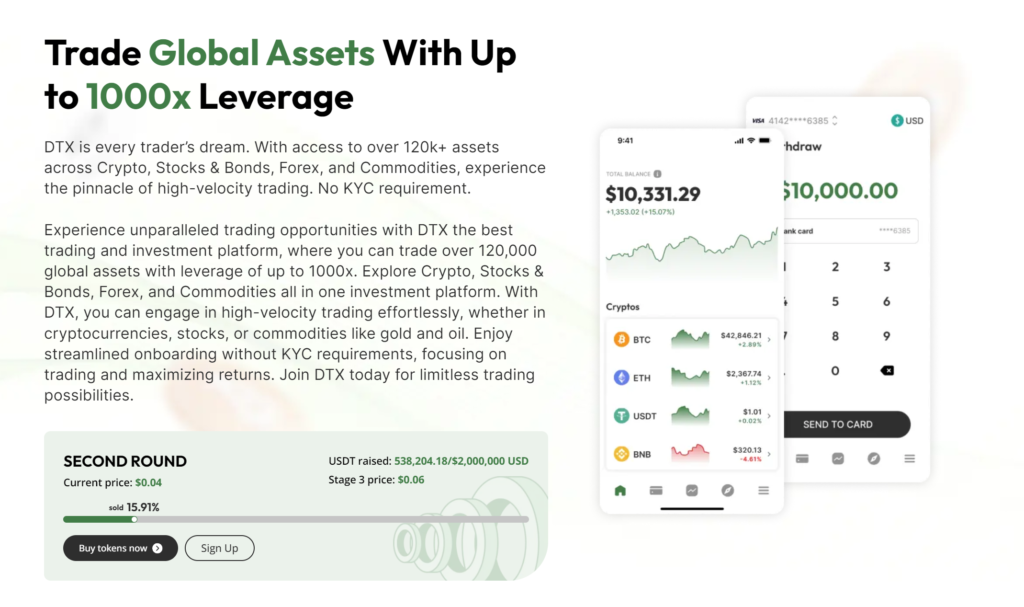

1000X Leverage

One of the standout features of DTX Exchange is its 1000X leverage. This allows traders to take larger positions with a smaller capital investment, potentially maximizing returns.

High Drawdown and Fund Availability

Coupled with its high leverage, DTX Exchange offers high drawdown and easy fund availability, providing traders with the tools to optimize their trading strategies.

Successful Presale and Token Growth

$0.04 Token Price Set for 50% Increase

DTX Exchange has already raised over $2M in a private seed round and $100K in a public presale within two days. With over $530K raised in the presale, the token, currently priced at $0.04, is projected to increase to $0.06 in the next round, offering early investors a lucrative opportunity.

Non-Custodial Wallet

A major feature of DTX Exchange is its non-custodial wallet, which allows users to maintain full control of their private keys and digital assets. This reduces the risk of funds being compromised in security breaches.

Vision and Objectives

DTX Exchange aims to bridge the gap between traditional financial systems and the crypto world, providing a secure, inclusive, and technologically advanced trading platform.

Financial Inclusion

By providing access to a wide range of markets and facilitating trading directly from users’ crypto wallets, DTX Exchange aims to empower unbanked individuals and promote financial inclusion.

Enhanced Security

DTX Exchange employs state-of-the-art security measures, including non-custodial storage solutions and on-chain verifications, to ensure users’ assets remain secure.

Liquidity and Accessibility

The platform enhances market liquidity through distributed liquidity pools, reducing slippage and ensuring a seamless trading experience regardless of market conditions.

Industry Overview

Challenges in Traditional Trading Platforms

Traditional trading platforms face several challenges:

- Centralization and Counterparty Risks: Traders must trust centralized platforms to handle their assets securely.

- Limited Access: Financial criteria and residency restrictions limit access.

- Lack of Diverse Asset Classes: Traditional platforms often focus on stocks, bonds, and commodities.

- High Fees: Traditional platforms charge high trading fees and hidden costs.

Emergence of Cryptocurrency Exchanges

Cryptocurrency exchanges offer lower fees, faster transactions, global accessibility, and 24/7 trading. However, centralized exchanges still face security risks, leading to the rise of decentralized exchanges (DEXs) that offer enhanced security and user control.

The DTX Protocol

Hybrid Model and Smart Contracts

DTX Exchange uses a hybrid model combining elements of centralized and decentralized exchanges, with smart contracts ensuring secure and automated transactions.

On-Chain Order Book

The platform employs an on-chain order book for transparent and verifiable trading processes.

Distributed Liquidity Pools

DTX Exchange enhances liquidity through distributed liquidity pools, aggregating liquidity from multiple sources for a more efficient trading environment.

Technical Architecture

Smart Contracts and Ethereum Virtual Machine (EVM)

DTX Exchange is built on the Ethereum blockchain, leveraging its smart contract capabilities and the EVM to ensure secure and transparent trade execution.

Decentralized Order Book

Managed by smart contracts, the decentralized order book ensures fair order matching and real-time trading with minimal latency.

Non-Custodial Wallets

Traders maintain full control of their assets with non-custodial wallets, reducing the risk of funds being compromised.

DTX Tokens

The native utility token, DTX Token, plays a vital role in platform governance and operations, offering benefits like reduced trading fees and access to premium features.

Solutions by DTX Exchange

Enhancing Liquidity

Distributed liquidity pools ensure competitive and consistent prices, reducing slippage and improving market depth.

Improved Security with Non-Custodial Storage

Non-custodial storage minimizes the risk of hacks and mismanagement, empowering users with control over their assets.

Financial Inclusion

Wallet-based trading allows anyone with an internet connection to participate, promoting financial inclusion.

Expanding Asset Classes through Tokenization

DTX Exchange offers tokenized assets representing real-world financial instruments, commodities, and tangible assets.

Platform Features

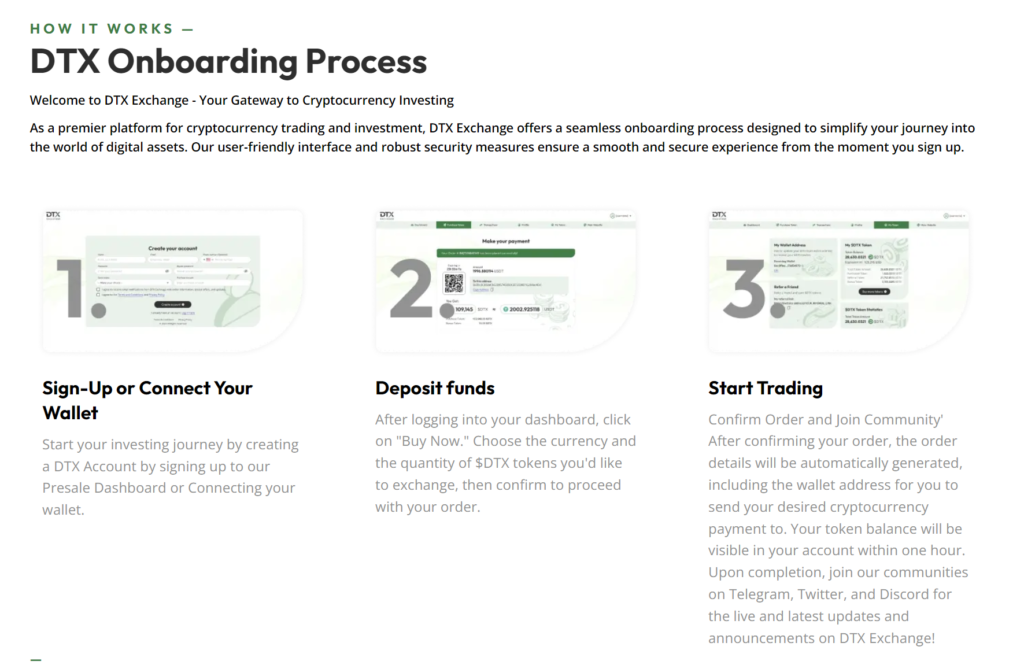

User-Friendly Interface

An intuitive interface ensures a seamless trading experience for both beginners and experienced traders.

Diverse Asset Offerings

DTX Exchange offers a wide range of asset classes, including cryptocurrencies, equities, FX, and CFDs, providing ample diversification opportunities.

Social Trading and Copy Trading

These features allow users to follow and replicate the trades of successful traders, enhancing learning and trading efficiency.

Advanced Trading Tools

On-chain analytics, trading signals, and trading bots empower traders with data-driven insights and automated strategies.

Community and Governance

Engagement and Support

DTX Exchange fosters a strong community through educational resources, social interaction, and feedback mechanisms.

Decentralized Governance

Token holders participate in platform decision-making, ensuring transparency and accountability.

Roadmap and Future Developments

Short-Term Goals

- Enhancements to the user interface

- Expansion of asset listings

- Introduction of advanced trading tools

- Launch of a mobile application

Long-Term Vision

- Further decentralization

- Expansion into new markets

- Introduction of margin lending and staking rewards

Integration with External Platforms

DTX Exchange plans to integrate with external exchanges, blockchain protocols, and DeFi platforms, enhancing cross-chain trading capabilities.

Conclusion

DTX Exchange is poised to revolutionize the trading industry with its innovative features, strong community engagement, and commitment to financial inclusion. With its promising presale success and ambitious roadmap, DTX Exchange offers a comprehensive and secure platform for traders and investors.

Learn more: