Bitcoin‘s (CRYPTO: BTC) halving has concluded, and in a surprising move, miners were some of the beneficiaries, despite the impact the change may have on their income statements.

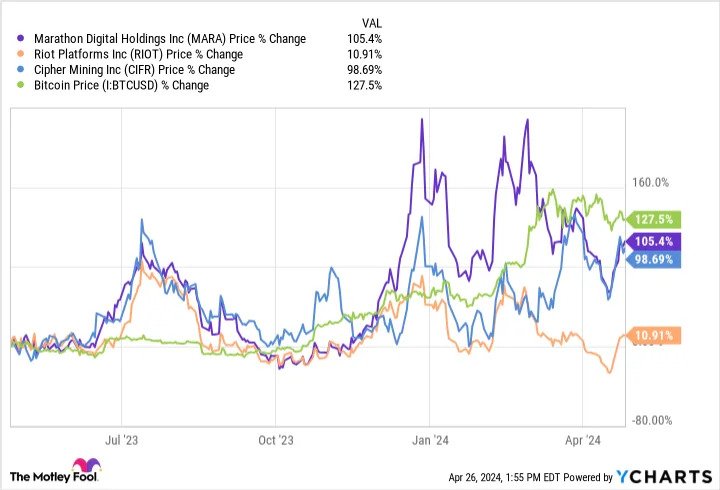

Riot Platforms (NASDAQ: RIOT) was the biggest beneficiary, according to data provided by S&P Global Market Intelligence, jumping as much as 36.3% this week, while Marathon Digital (NASDAQ: MARA) was up as much as 20.1% and Cipher Mining (NASDAQ: CIFR) rose 20.3%. The stocks were up 33.1%, 17.8%, and 19% respectively, as of 2 p.m. ET Friday.

Bitcoin’s halving

Earlier this week, Bitcoin’s halving took place, and as a result, each block reward was cut nearly in half. In theory, this means revenue in terms of Bitcoin per block drops, but the reality is likely fewer competitors in the market.

Miners with low margins before the halving will likely be forced out, leaving stronger companies to take what’s left. More market share along with a higher Bitcoin price could mean more profits.

The halving and Bitcoin’s price

Bitcoin goes through a halving about every four years, and in the past, it’s coincided with a sharp increase in price. This is partly because of speculation and partly because the halving itself requires a higher price to keep block production going.

What’s not clear at this point is whether that trend will continue. The compute and energy usage for Bitcoin mining has gotten so expensive that it now takes hundreds of millions of dollars in investment to make a business out of it.

Catching up to Bitcoin

It’s possible the increased market share will be positive for miners, but at the end of the day, they need to make money on the spread between their costs and the price of Bitcoin. And Bitcoin itself is down 0.8% over the past week, so that’s not helping.

Keep in mind that miners often keep a large portion of Bitcoin on their balance sheets as a way to magnify exposure to the cryptocurrency. That’s a double-edged sword on the way down though if Bitcoin drops.

Part of what we’re seeing is a recovery to the Bitcoin price trend. Miners were likely undervalued after dropping the last few weeks, and that led to a quick recovery this week.

The long-term picture for miners

What investors will want to watch is both the price of Bitcoin and the costs these miners face. Higher interest rates and utility costs will be headwinds to their operating expenses.

I think the competition for computing power is only going to get stronger, and the falling revenue potential for these companies will make it harder to make money. The only cure is the rising price of Bitcoin, but that too may have its limits. Bitcoin now has a market cap of $1.3 trillion, and a lot of the tailwinds from ETF approvals are now behind us. That’s why I’m staying out of Bitcoin mining stocks today.

Should you invest $1,000 in Riot Platforms right now?

Before you buy stock in Riot Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Riot Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $506,291!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

Bitcoin Miners Jump This Week After the Halving was originally published by The Motley Fool