RoaringKitty, an investor, analyst, and influencer, has returned to social media after a 3-year hiatus. They are best known for orchestrating the GameStop ($GME) short squeeze in 2021, which pushed the price of GME from $5 to $81 in less than a month

The GME pump popularized the concept of “meme stocks,” where company shares increase in price due to social virality, and are often associated with short squeezes, which occur when traders who bet against an asset are forced to close their positions or risk liquidation, resulting in tremendous upward pressure on the asset’s price.

Following RoaringKitty’s tweet, GameStop stock surged from $20 to $29, briefly reaching $38.

Memecoins have also rallied as traders speculate that RoaringKitty’s return might bode well for the sector. Since the tweet, PEPE is up 20%, and the GME memecoin is up roughly 1500%.

The Defiant Daily

“an industry must-read”

Get an edge in Crypto with our free daily newsletter

Know what matters in Crypto and Web3 with The Defiant Daily newsletter, Mon to FriSubscribe

90k+ Defiers informed every day. Unsubscribe anytime.

Crypto Markets Drop on Disappointing U.S. Economic Data

By: Mehab Qureshi May 10, 2024

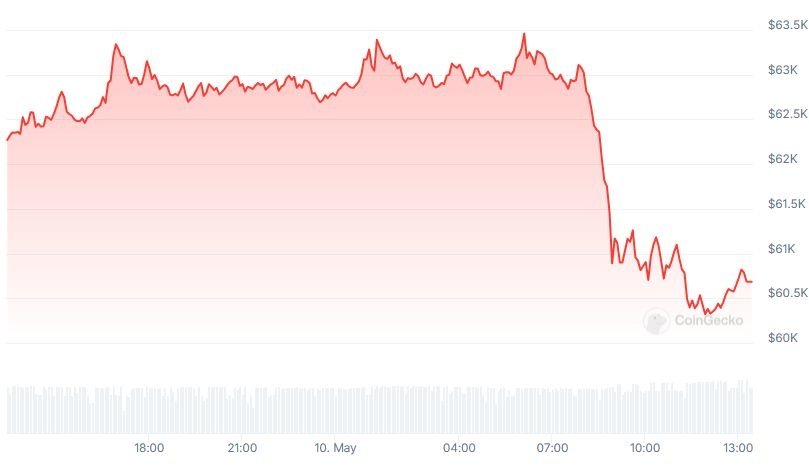

Crypto markets fell sharply on Friday morning, reversing an earlier rally that had propelled the world’s largest cryptocurrency to as high as $64,212 this week.

Bitcoin (BTC) is trading at $61,015 — down 2% in the last 24 hours. Ether (ETH) is down nearly 4%, with Dogecoin (DOGE) tumbling over 3.5%. Most digital assets in the CoinGecko top 100 posted losses.

The catalysts for the drop in crypto prices were disappointing U.S. economic data and hawkish remarks from Federal Reserve Bank of Dallas President Lori Logan.

“It’s just too early to think about cutting rates,” Logan said on Friday at an event in New Orleans. “I need to see some of these uncertainties resolved about the path that we’re on and we need to remain very flexible to policy and continue to look at the data that’s coming in and watch how financial conditions are evolving.”

Consumer sentiment data released Friday morning showed a significant increase in inflation expectations, dampening market enthusiasm. The preliminary May reading for the University of Michigan’s consumer sentiment index was 67.4, falling well below the Dow Jones estimate of 76 and representing its lowest reading in six months.

Since their July 2023 meeting, Fed officials have maintained the benchmark U.S. interest rate at a steady range of 5.25% to 5.5%.

Token unlocks loom

Crypto analytics firm 10x Research reported on Wednesday that over $2 billion worth of tokens will be added to circulation in the next two months.

The report notes that $97 million of Aptos (APT), $79 million of Starkware (STRK), $94 million of Arbitrum (ARB), $330 million of Avalanche (AVAX), and nearly $1 billion of SUI (SUI), among others, are slated to be unlocked.

“A rapid succession of nearly $2 billion of token unlocks during the next ten weeks could lower the market for altcoins,” said 10x Research in a report seen by The Defiant.

According to Michael Van de Poppe, CEO of MN Trading, Bitcoin is currently at its range low.

“This is technically the area where you’d prefer to see it hold, so the upward momentum continues, and the range holds,” he said on X. “If this doesn’t hold, then we might expect $52-55K as a potential low on this correction.”

Grayscale Bitcoin Trust sees inflows

In May, the Grayscale Bitcoin Trust (GBTC) saw inflows of $66.9 million, a change after experiencing continuous outflows totaling over $17.5 billion in the last 78 days following its Jan. 11 conversion into an ETF.

Meanwhile, BlackRock’s iShares Bitcoin Trust (IBIT) has attracted the largest amount of capital, totaling nearly $15.5 billion to date.